Grantee Client Impact

Read stories from LSC grantee clients, detailing the positive impact that civil legal aid has had on low-income Americans.

Julie: Rebuilding After Hurricane Harvey

After Hurricane Harvey destroyed her home in 2017, a senior in Texas faced numerous challenges in rebuilding. With the help of LSC-funded legal aid, she was able to get her application for disaster relief approved and begin building her new home, providing her with stable housing for the first time in years.

Disasters, Seniors • TX

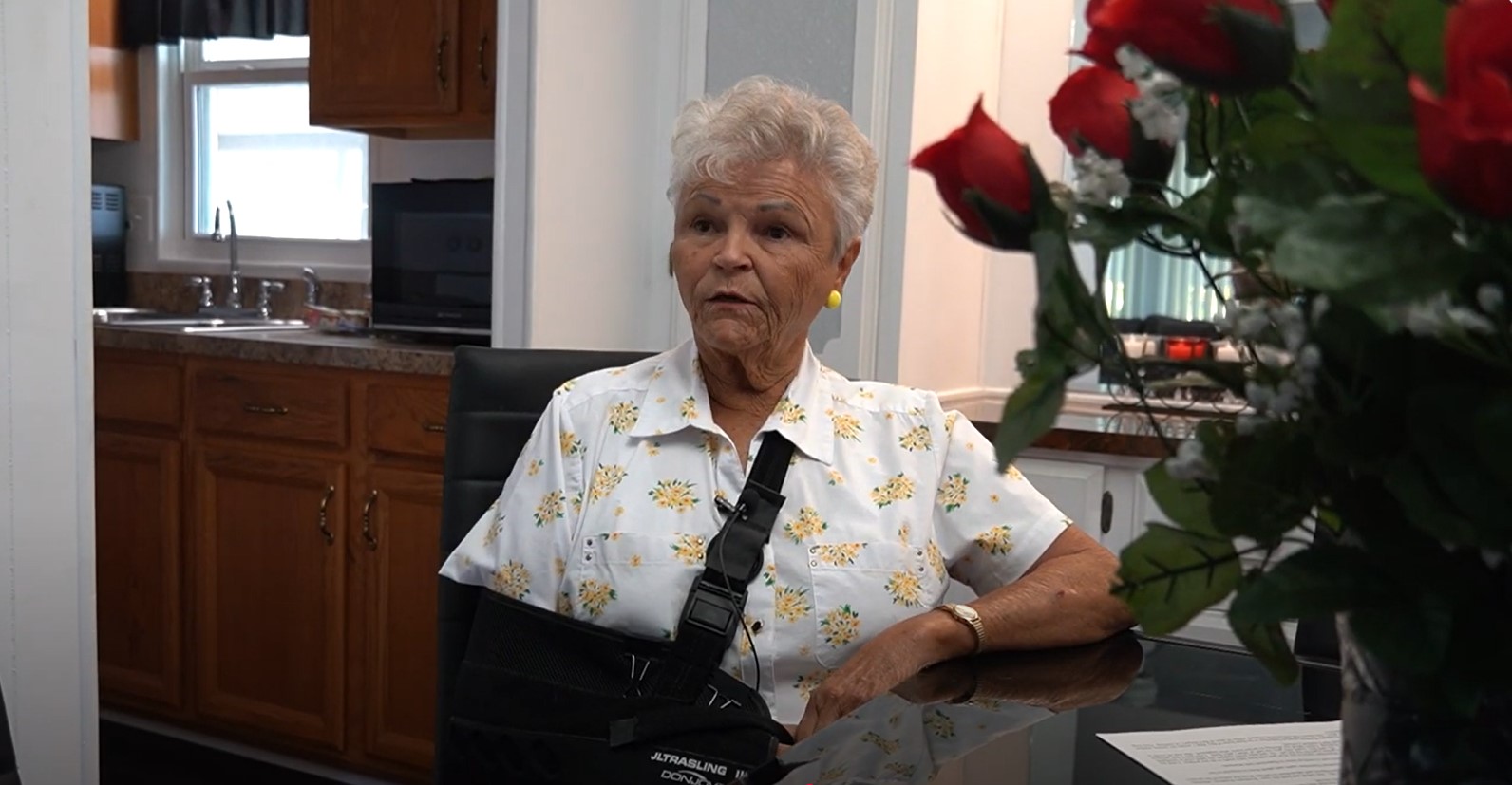

Coleen: Widow Recovers Life’s Savings from Scammer

A Florida widow used what life’s savings she had to repair her home after it was devastated by a hurricane. But the contractor she hired never showed. With the help of LSC-funded legal aid, she recovered most of her money, which she used to finally make the needed repairs to her home.

Disasters, Seniors • FL

Dave: Farmer Saves Livelihood with Legal Help

A farmer in North Carolina didn’t know how his family would survive, after a tropical storm devastated his farm. LSC-funded legal aid helped him overturn a denied FEMA application and save his family’s livelihood.

Disasters, Seniors • NC

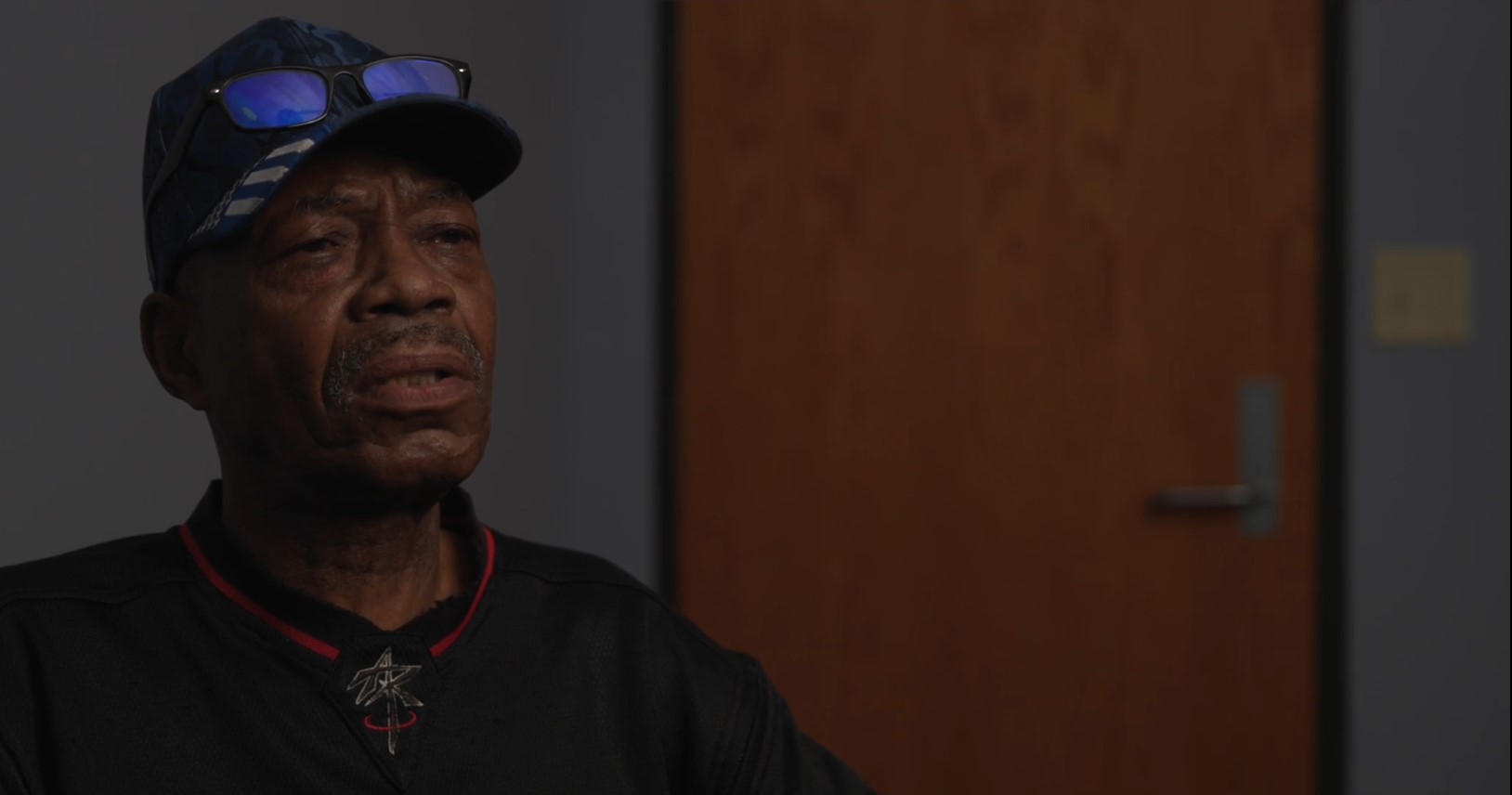

Larry: Senior Veteran Resolves VA Debt

A senior Navy veteran and his wife faced possible homelessness when a VA overpayment threatened to garnish his income. An LSC-funded medical-legal partnership discovered the overpayment was due to error and cleared the debt, giving Larry peace of mind.

Veterans, Seniors • LA

Pierre: Single Father Regains Custody of His Son

A single father’s life was changed by LSC-funded legal aid, helping him regain custody of his son and inspiring him to pursue a career in law to help others.

Family Law • CA

Monica: Protected from Domestic Violence

At 18-years old, a young mother escaped an abusive marriage with the help of LSC-funded legal aid, including a restraining order and free legal assistance to get sole custody of her son.

Domestic Violence • IL

Graham: The “Blessing” of a Fresh Start

Graham Taylor has been through difficult times. Now, he's ready for a fresh start for him and his wife. Thanks to Kansas Legal Services, that is now possible.

Expungement • KS